Your Pathway to Become CPA

Step 1: Get started

Enrol with Invisor for CPA and get your CPA Surgent CPA textbook at your home

address. Our Faculties will be having a 1 on 1 connect with you to design your CPA

journey.

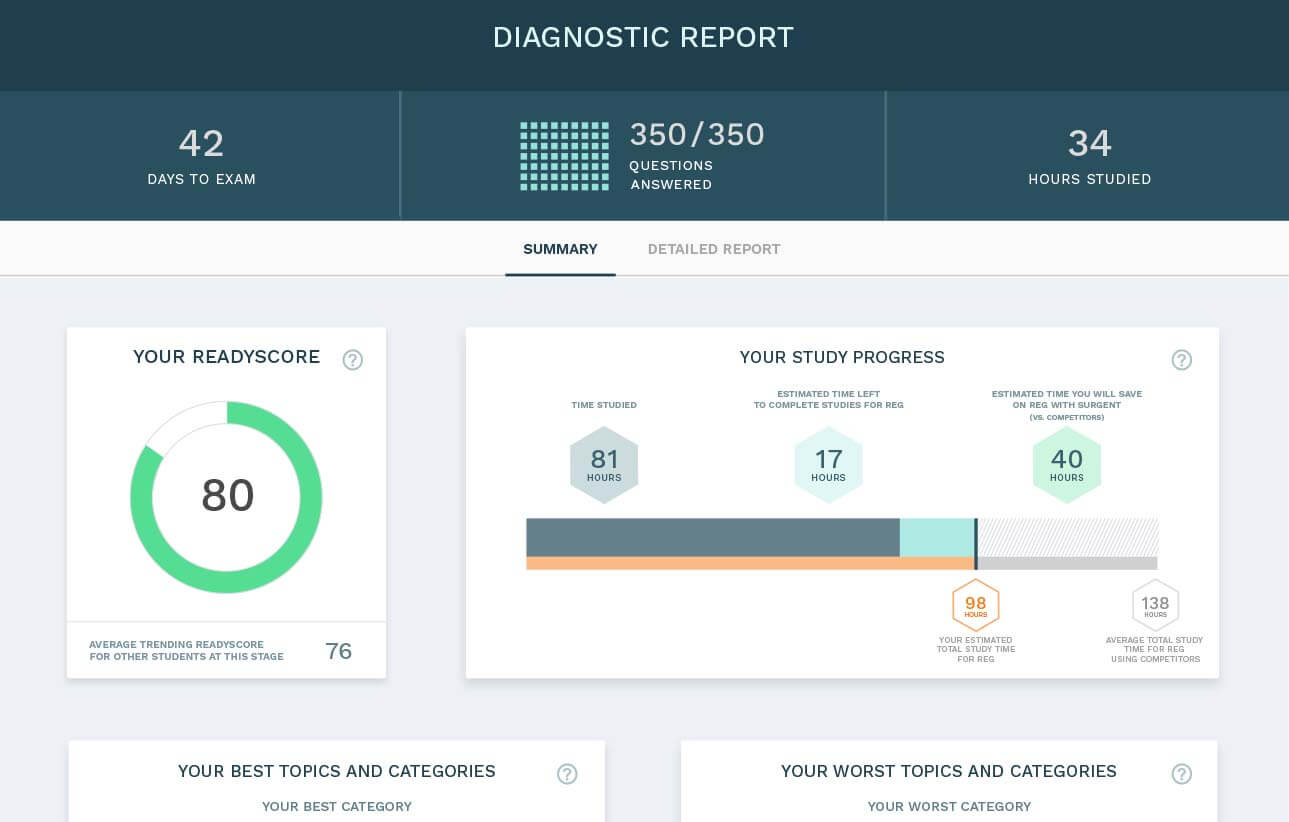

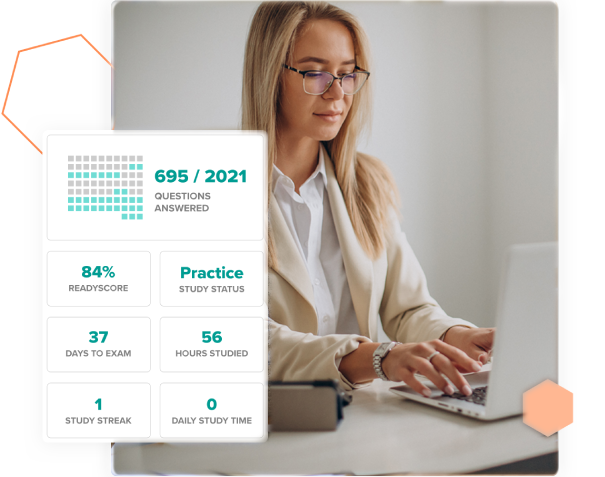

Step 2: Find out what you already know

You complete a selection of Multiple-Choice Questions (MCQs), and your answers

enable the software's algorithm to gauge your knowledge across all CPA Exam content.

From there, you receive a hyper-personalized study program, thanks to our A.S.A.P.

Technology®.

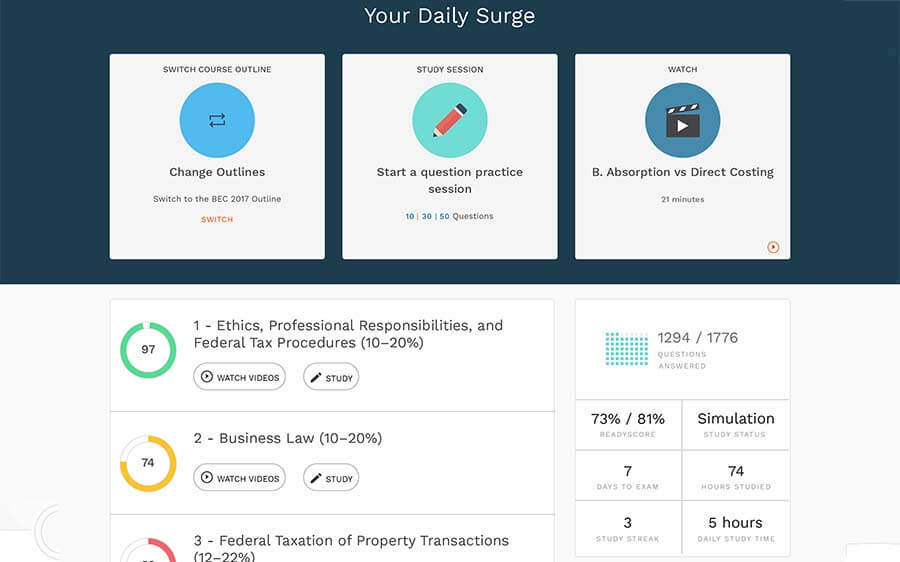

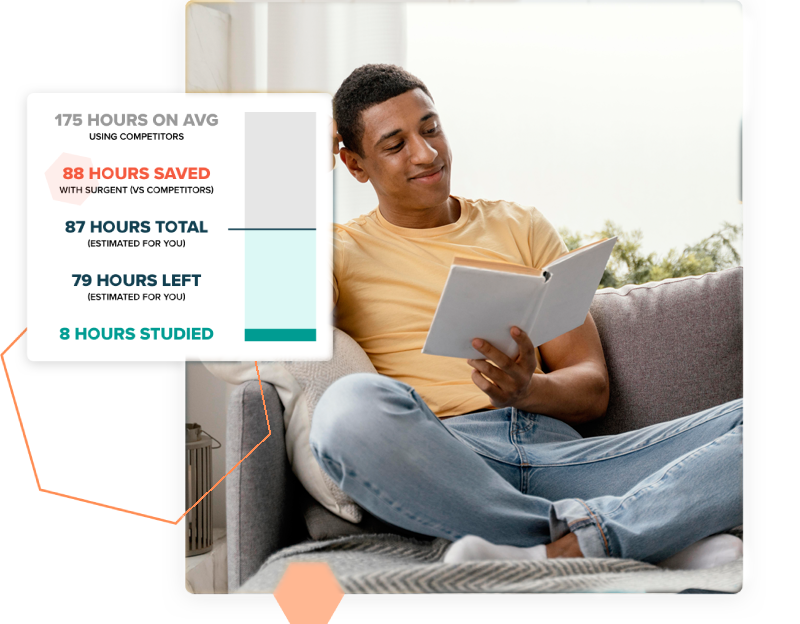

Step 3: Study and succeed

We’ll help you study what you need to focus on to pass. As you follow your custom

study plan, your ReadySCORE™ accurately and clearly indicates your CPA Exam

readiness. Candidates improve their ReadySCORE, on average, from a 43 to an 84 while

studying.

Step 4: Pass the test

All your hard work pays off on test day. Students with a ReadySCORE of 75 or more

pass the CPA Exam a remarkable 92% of the time (vs. national average pass rates,

which hover around 50%). And your goal of becoming a CPA? Check!